Chapter Six

Twelve Month Moving Premonitions

Before we could make our mini indispensable, we

discovered that there were preliminary hurdles we had to

cross, because the sight of simple things like routine hardware

and software maintenance sent the natives scattering like

nervous sparrows. It was as if feeding a cartridge into the

machine might expose them to something contagious, obscene or

at least uncouth. To our relief, they were not overtly hostile;

they had no trouble at all in referring to it as rubber ducky, but

in a tone that revealed more jitters than pure disparagement. It

was more a case of being afraid to be curious. Their avoidance

did not extend to making the computer's presence unspeakable.

In fact, they almost vied for the opportunity to make a clever

remark about our little beast. This would be the hook we

needed to draw them in. We needed to be quick, to get the game

afoot, to keep the ball in play. Before the novelty wore off, we

had laid a threefold plan of marketing, service and

entertainment.

Our marketing objective was straightforward; create a

positive aura that would induce the natives to consider our

overtures. At the very least, it was important to keep the

tribes engaged so they could not ignore our feats, diminishing

them into insignificance, virtual oblivion. With the power to

solve so many of their dilemmas it seemed so frustrating that

we should need a campaign to overcome their reluctance. We

responded warmly to any comer but our main tactic was to

repeat the successful stir created by our mini's accidental

naming. Carefully, I christened each of our ventures to invite

their curiosity, to amuse and provoke delight, to calm their

tribal jitters, to stay always in their mind's eye.

The actuarial staff, by contrast, withdrew into their

officially defined spaces, aloof on good days and arrogant on

bad ones. It was not uncommon to hear a phone slammed down,

to meet a glowering countenance. There was no measuring the

bad grace of the trainee actuaries or their chief, none of whom

was ever seen to consult or mingle. This clearly helped us now

and again but it made it difficult to properly gauge their

strength.

My unofficial staff's natural sensitivity to the tribe's

feelings and our eagerness to ease the chiefs' discomfort, to gain

their trust, was a matter of considerable pride among us. These

skills were so undervalued in the market and their value so

apparent to us that we may have over-valued them, but only in

the same proportion as we felt would compensate for the

market's injustice. This part of our strategy clearly aided our

marketing effort but it made it impossible not to despise our

adversaries for their deficiency, an unhealthy attitude that

has frequently been a serious source of strategic error in

campaigns, and will certainly be again.

But for the moment, their bad grace might be made use

of, and so we undertook an extensive plan of entertainment...

...

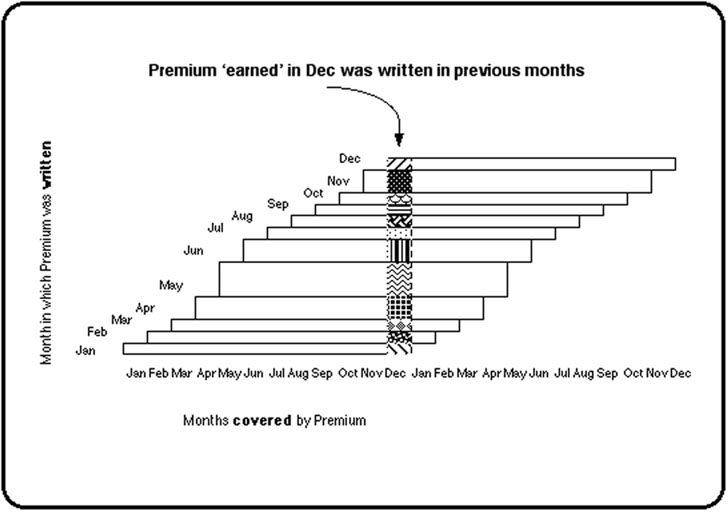

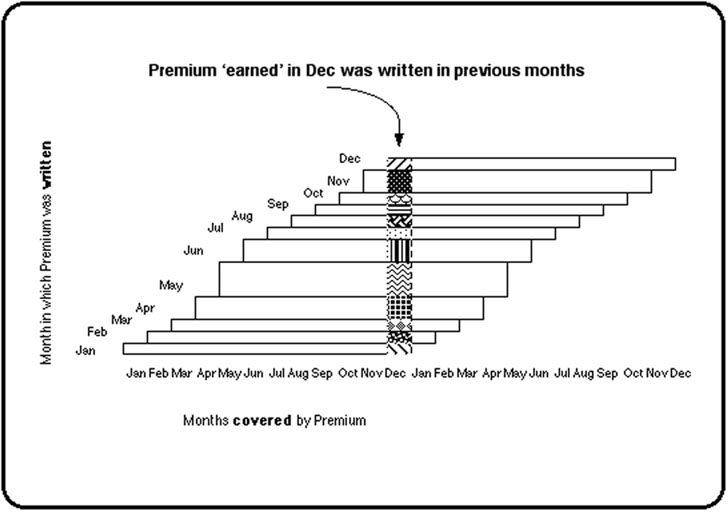

Since premium-year data was reported only annually, I

needed to find an approximation that was available more

frequently. The closest choice for my basis was the

accident-year data that I had encountered on my forays into claims

and accounting. Claims were reported monthly but were categorized

by accident-year, which, with some calculating sleight of

hand, could be used as a surrogate for the claims component of

premium-year data. The trick was to replace the written

premiums that accounting recorded with a construction called

earned premium which would then serve as the corresponding

surrogate for our needed ´accident-year premium´. Earning a

month´s premium was a straightforward process of allocating

the total premium written over the previous twelve months

into monthly segments and then tallying the segments that

belonged to the current month. This amount gave an estimate of

the risks to be covered in that month. It measured our exposure

and should have been comparable to the accidents occurring

over that time period if the premiums in force were adequate

for their intended risks.

Where the planning project had been fundamental

number-crunching, this bridge was a high-tech statistical

construction that gambled on the limited histories we had

gleaned from accounting as well as assumptions about

appropriate curves to fit them. The histories of accident year

data had one more drawback; they were recorded in year-to-date

form. Since this form was extremely unstable for the first

few months of the year, it was not only potentially deceptive

during those early months but it also made it difficult for the

chiefs to use this form as a basis for any corrective action until

much of their maneuvering time before year-end was gone.

Though it suited the chiefs in accounting, it was less than

satisfactory for the decision needs of senior chiefs. For those

decision purposes, which it was our intention to support, we chose to

calculate a more appropriate form called twelve-month-moving data,...