Chapter Eleven

Mathematical Models or My Kingdom for a Lotus

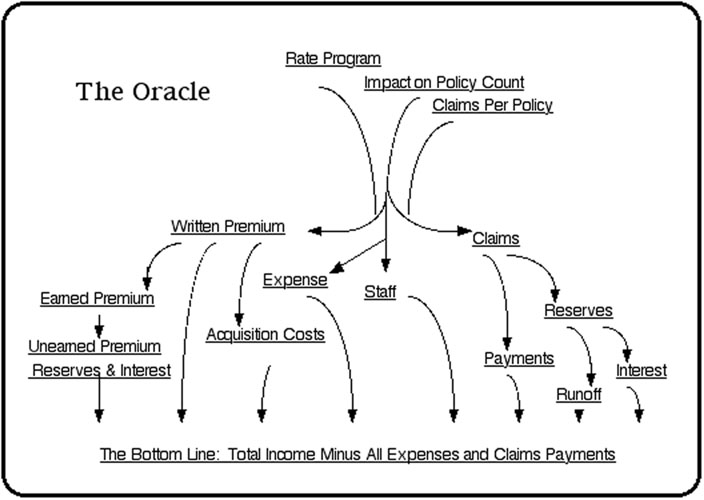

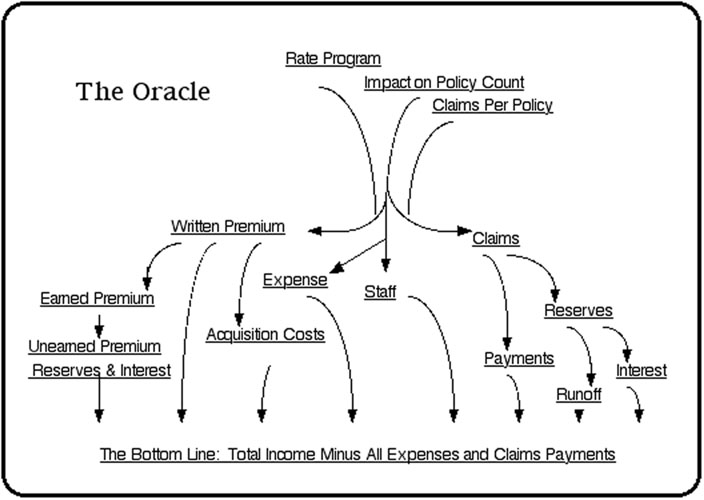

The specialized mathematical models that we had

built for our many diverse projects were beginning to cover every

aspect of our operation and the impulse to connect them into one

grand comprehensive construct was irresistible to any dreamer

of castles. In our lunchtime scheming, KGH had been sketching

coming crises and rumors of fears in the market. The outlines of

the missing towers and moats, together with strategies of their

use, were taking shape.

We would only need to add modules to produce

estimates of expense and investment income. Those would

complete our picture of the company's status. The links to

connect these modules to our main models, Crystalball for exposures

and Houdini for claims behavior, already existed. When the

technical details of the programming connections were

tested and assembled, we would hope for a balance of

robustness and sensitivity.

Because of the growth capacity inherent in accounting's

computerization, the expense module could be built around the

written policy count using incremental rates and staff

productivities. Acquisition costs could be treated as a spinoff

from the same policy count along with the premium rates, the two

mainsprings of our exposure model. Investment income that

flowed from the unearned premium reserves, specifically the

use of premium funds until related claims occurred and were

reported for payment, could be based on the complement of our

exposure calculations of earned premiums; the arrival of claims

being, in a sense, the earning of our premium and the end of its

initial availability for investment. This part of our investment

income, as well as the expenses, acquisition costs, and the

premiums themselves would flow to the bottom line at the

appropriate points in time. The earned exposures would flow to

the claims model on their own timetable.

The claims model would then produce the tables of

simulated, reported claims, their payment histories, their

reserves and their so-called runoff, that excess over, or

shortfall from, those reserves as the claims settled over time.

The remaining part of investment income, that part arising

from the use of moneys held for the eventual payment of

reported claims, could be simulated from the tables of reserves

generated by our claims model. This component of the

investment income along with the claims' impacts then flowed

to the bottom line at their appointed times.

The whole structure would only require input about the

rates, the resulting policy counts and projections of claims count

per policy. Elegantly manageable. But before we would ask

this grand model to draw the picture of the company's future

bottom line emerging from choices of these few considered inputs,

there would be a wealth of parameters to fine tune, such as

various inflation rates, commission rates, interest rates, staff

productivity. We would need to know what size changes in

each of these parameters, or combinations of them, made

substantive changes in the company future. If any proved

sensitive, they would need to be treated as variable rather

than parameter.

Because of the myriad delays inherent in the claims model,

identifying the possible impact of any combination of

input variables on the future would require an examination of

the bottom line over an extended time frame. Our resulting

picture of net status would need to be a sequence of yearends in

order to describe the full impact of a given combination of rate

strategy and market reaction. The perfect summary values to

decorate the ends of a decision tree's branches!

As we put this model through testing, it exhibited such

realistic behavior as we flexed its inputs and parameters, that

it was more orrery; too mobile to envision it as stolid structure.

It was sheer pleasure to watch it perform. To seek its insights

was to approach a soothsayer and we so christened it. Our

Oracle would be Houdini with a Crystalball, in a Pear Tree.

Rumors of our successes had been entertaining Home Office

for some time now and, in spite of our titles, London

summoned us for an audience with their chiefs to see what we

provincials were like, to see for themselves what magic we

possessed, that they had found nowhere else. Not only were

our systems, models and techniques very exciting but the tools

we had at our disposal were the rough leading edge of

technology and esoteric new languages; no such creatures yet as

spreadsheets or modeling systems.

We had a couple of months to prepare our exhibits, to

gather our programs, to pack our bags and still when the days

grew short there were surprises...