Chapter Ten

Bayesian Underwriting and Commercial Fires

Our sibling organization in the States to the South was

experiencing a problem in their commercial underwriting. It

was said that mobility and rising expectations were depleting

their pool of knowledgeable underwriting staff. The situation

was particularly acute for their commercial risks. These risks

required a highly seasoned underwriter, someone who had been

exposed to a broad range of businesses, from retail stores to

manufacturing to storage facilities; someone who knew the

basic construction techniques of typical physical plants;

someone who could assess a company's basic financial health;

someone who had accumulated a mental database of accidents

and their causes; someone who could put all these pieces

together into a gut-feel about a prospective insured's level of

risk compared to others in their class. Now we knew that these

skills required many years, broad exposures and much insight to

develop. Our indians relied on long apprenticeships filled

with observation, and access to senior sages, to reach this level

of proficiency in measuring our risks. Some called it 'sitting by

Nelly', one of KGH's favorite analogies.

Although the Southern tribes were glutted with vice-presidents

and fancy titles, their research resources were enviable

and they were now planning a major assault on their

underwriting difficulties. They hoped to capture the thought

processes of their senior sages and use this expertise to improve

the underwriting results of their junior staff. For this venture

they were allocating major amounts of time and money in a

process involving conferences and consultants, computers and

controversial theories. Our chiefs expected that the real cause

of their problems was inflated hype and an unwholesome taste

for self-flagelation. But inflation had come to Canada and we

were seeing rising attrition among our branches' junior staff, so

our chiefs were open to observing what our Southern sibling

would try. Being esoteric, it became our group's mission. The

funding for our participation however was severely

constrained. We would be allowed occasional visits only, not

massive amounts of consultants' time nor many extended

conferences with dozens of senior underwriters from around the

country. That was Southern style.

This clearly very limited objective however held little

benefit for our cause. Our scheme was to build an actual

prototype of the expert system on our mini, with enhancements

of our choosing and without waiting to see the Southerners'

final solution. This ambitious project, originally code named

C.A.R.E. for Computer Assisted Risk Evaluator, we christened

Nelly. For our female sage, our Nelly, civility would be second

nature; and we also planned to incorporate an automated

version of the underwriting manual for commercial fire. This

volume was a huge compendium of rules, standards, codes,

instructions, exceptions. Comprehensive and intimidating, this

resource, though vital to the underwriters, not only was a

daunting challenge to the junior staff but was frequently in need

of updates. Those replacement pages and additions issued by

the chiefs did not always reach their intended destination in

each and every copy of the book. A central automated version

of the manual would be more manageable for both chiefs and

indians. Although our prototype would only test the guidance

function for our indians, the benefits of having to keep only our

one final mainframe version current would make life simpler for

the chiefs.

By integrating the manual with an expert system that

emulated the thought processes of a senior chief as he combined

the required assessments into a rating and then calculated the

company's available capacity, of all kinds, our own and

reinsurers, Nelly would make expertise more available to each

indian while relieving the sages to concentrate their

consultations on finer points. The junior staff could easily ask

Nelly hypothetical questions or what difference it would make

if some borderline assessment had been different, which would

tell him whether it was important to investigate further. To

complete the package, our indians could send their results to

print, eliminating transcription errors as they documented their

work for the underwriting files.

We were excited at the promise this project held for

the company. Our unwashed irregulars' approach held more

benefit and was orders of magnitude less costly. After

considering the Bayesian basis, I felt sure that I could take this

on, even though the concept of a computer emulating an expert's

thought processes was new and controversial. KGH took pains

to reassure the systems tribe that we had no designs on their

territory. Overextended, they were feeling more than a little

unappreciative of suggestions that would complicate their

lives. We knew the actuaries, in order to reduce their computer

expenses, were attempting...

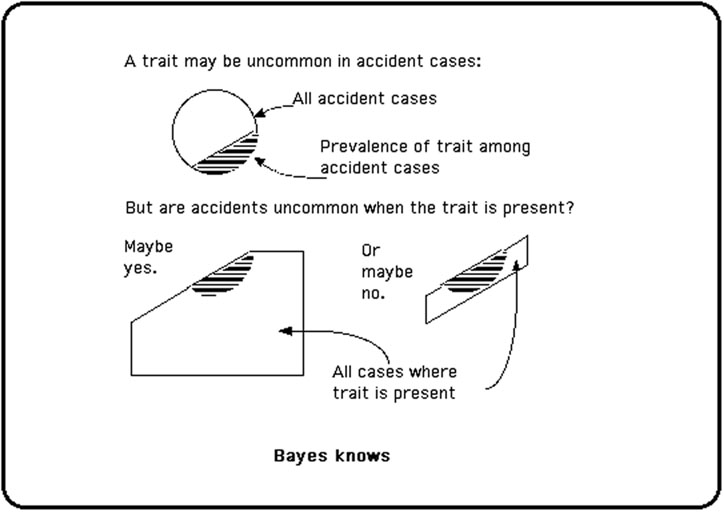

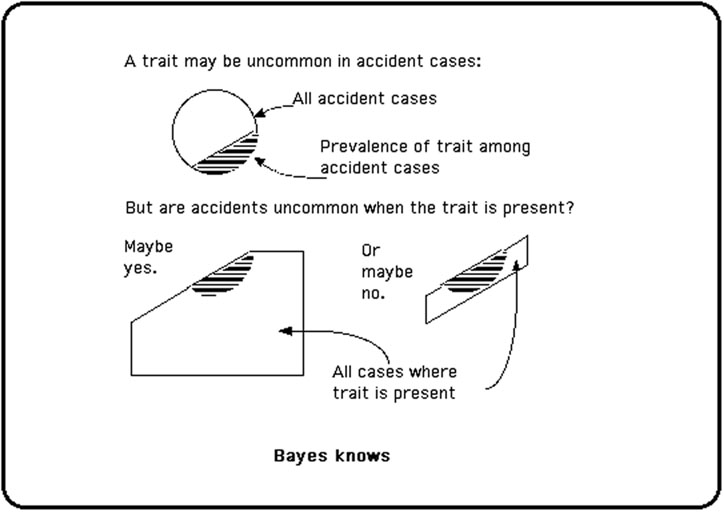

The Bayesian basis was not quite as simple as the usual

textbook presentation. In principle, Bayes is a formula for

reversing the relationship between clue and result, exactly

what our sages required. In the sage´s accumulated experience,

they see the frequency of clues in their population of accidents

but to underwrite a prospective insured they need the frequency

of accidents given the presence of the clues. Basic Bayes says

that the missing piece, the key to reversal, is the frequency of

the clues in the general population. This information our sages

draw from their knowledge of the marketplace.

The complications come when there are clues of

different natures not all predicting the same level of risk...